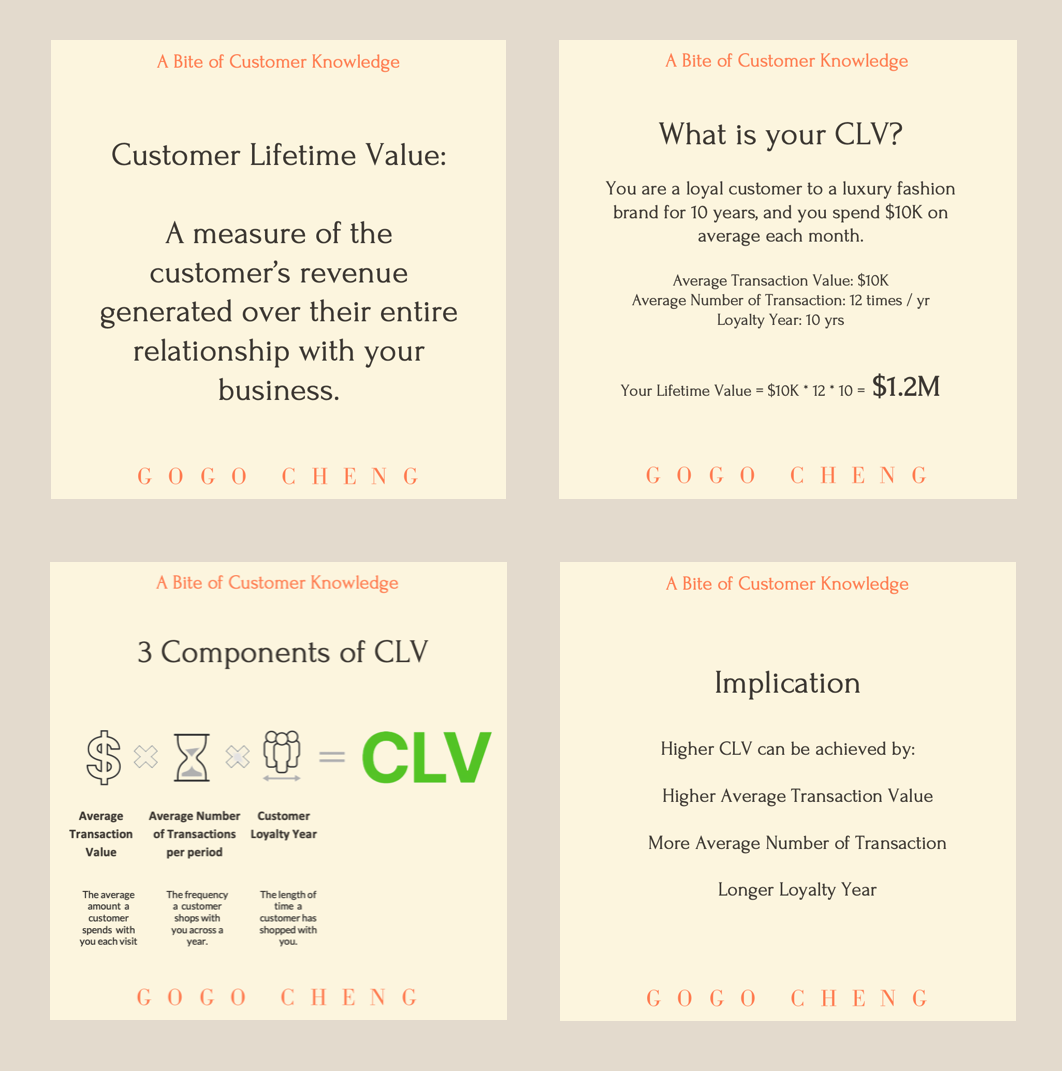

If your business is not evaluating the Customer Lifetime Value (CLV), you are missing out on a holistic perspective to evaluate your clienteling effectiveness and the potential business threats.

𝗔𝘃𝗲𝗿𝗮𝗴𝗲 𝗧𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻 𝗩𝗮𝗹𝘂𝗲 (𝗔𝗧𝗩) 𝘅 𝗔𝘃𝗲𝗿𝗮𝗴𝗲 𝗡𝘂𝗺𝗯𝗲𝗿 𝗼𝗳 𝗧𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻𝘀 𝗽𝗲𝗿 𝘆𝗲𝗮𝗿 (𝗔𝗡𝗧) 𝘅 𝗖𝘂𝘀𝘁𝗼𝗺𝗲𝗿 𝗟𝗼𝘆𝗮𝗹𝘁𝘆 𝗬𝗲𝗮𝗿 (𝗖𝗟𝗬) = 𝗖𝘂𝘀𝘁𝗼𝗺𝗲𝗿 𝗟𝗶𝗳𝗲𝘁𝗶𝗺𝗲 𝗩𝗮𝗹𝘂𝗲 (𝗖𝗟𝗩)

Some suggested aspects to dive into CLV are:

💡 Compare your customers’ “Last Year Spending” vs their “Average Annual Spending” (CLV/CLY) to highlight any significant spending dropped/increased cases; Proactively understand the reason behind and develop a personalised clienteling action.

💡 Use “Customer Loyalty Year (CLY)” as a key indicator when prioritising whom to reward – one’s years of loyalty speak more than the total spending.

💡 Highlight any customers with high “CLV” yet low “Average Number of Transactions” or “Customer Loyalty Years” and understand their purchase motivations and behaviours accordingly. These could be gifting or travelling clients that require a different engagement plan.

Does your business evaluate CLV? If so, how do you use this information to evaluate customer retention effectiveness? Please share your perspective with the community. 🔦